RAKEZ Approved Auditors in Ras Al Khaimah, UAE

Companies registered under the Ras Al Khaimah Economic Zone (RAKEZ) are required to submit audited financial statements annually. To ensure regulatory compliance, RAKEZ only accepts audit reports issued by officially approved audit firms.

Our firm works with RAKEZ-approved auditors to help businesses meet statutory requirements efficiently and on time.

What Are RAKEZ Approved Auditors?

RAKEZ approved auditors are audit firms that are:

- Recognized by Ras Al Khaimah Economic Zone

- Licensed to operate in the UAE

- Qualified to conduct statutory audits

- Compliant with International Financial Reporting Standards (IFRS)

- Experienced in free zone and mainland regulations

Only reports issued by these auditors are accepted for license renewal and regulatory filing.

Why You Must Appoint a RAKEZ Approved Auditor

Appointing an approved auditor is mandatory for most RAKEZ-licensed companies. Using a non-approved firm may result in rejection of your audit report and compliance delays.

With a RAKEZ approved auditor, you benefit from:

✔ Regulatory compliance

✔ Smooth license renewal

✔ Accurate financial reporting

✔ Improved business credibility

✔ Reduced risk of penalties

Who Needs a RAKEZ Approved Audit?

RAKEZ audit requirements apply to most registered entities, including:

-

Free Zone Establishments (FZE)

-

Free Zone Companies (FZCO)

-

Branch offices

-

Industrial and commercial entities

-

Professional service companies

Whether your business is active, semi-active, or restructuring, audited financial statements are usually required.

Our RAKEZ Audit Services

We provide complete audit and assurance solutions through approved audit partners, including:

Statutory Audit

-

Annual financial statement audit

-

IFRS-compliant reporting

-

Auditor’s opinion and certification

-

Submission-ready reports

Internal Audit

-

Review of internal controls

-

Risk assessment

-

Process improvement recommendations

Compliance Support

-

RAKEZ audit filing assistance

-

Corporate Tax documentation

-

VAT reconciliation

-

ESR compliance support

Advisory Services

-

Financial restructuring

-

Accounting system setup

-

Management reporting

-

Business performance review

Our Audit Process

We follow a structured and transparent audit approach:

1. Initial Assessment

-

Understanding your business activity

-

Reviewing accounting systems

-

Identifying risk areas

2. Planning

-

Defining audit scope

-

Scheduling timelines

-

Document checklist preparation

3. Fieldwork & Review

-

Transaction testing

-

Bank and balance confirmations

-

Verification of records

-

Compliance checks

4. Reporting

-

Preparation of audited financial statements

-

Issuance of audit report

-

Management recommendations

5. Submission Support

-

Assistance with RAKEZ filing

-

Follow-up on approvals

-

Renewal coordination

Documents Required for RAKEZ Audit

To complete your audit smoothly, the following documents are usually required:

-

Trial balance and general ledger

-

Bank statements and confirmations

-

Sales and purchase invoices

-

Expense records

-

Fixed asset register

-

VAT returns (if applicable)

-

Contracts and agreements

-

Payroll records

Our team helps you prepare and organize all required documents.

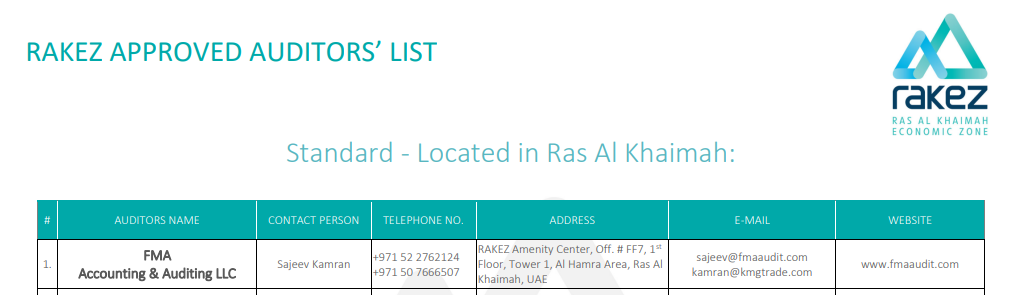

How to Verify RAKEZ Approved Auditors

Before appointing an auditor, you should:

✔ Check RAKEZ’s official approved auditor list

✔ Confirm the firm’s trade license

✔ Verify professional certifications

✔ Review past client experience

We ensure that all audit partners we work with meet RAKEZ requirements.

Why Choose Us for RAKEZ Audit Support?

Businesses trust us for our:

✔ Access to RAKEZ approved auditors

✔ Experienced audit professionals

✔ Competitive and transparent pricing

✔ Timely completion

✔ Dedicated client support

✔ Strong regulatory knowledge

We focus on building long-term relationships and delivering reliable compliance solutions.

Audit Deadlines and Compliance

Most RAKEZ companies must submit audited financial statements within six months of their financial year-end.

Late submission may lead to:

-

Fines and penalties

-

Delays in license renewal

-

Restrictions on services

-

Compliance notices

We help you meet all deadlines without stress.

Frequently Asked Questions (FAQs)

Is audit mandatory for all RAKEZ companies?

Yes, most RAKEZ-licensed entities are required to submit audited financial statements annually.

Can I use any audit firm?

No. Only RAKEZ approved auditors are accepted.

How long does a RAKEZ audit take?

Typically 2 to 4 weeks, depending on business size and record quality.

What is the cost of a RAKEZ audit?

Audit fees vary based on turnover, activity, and complexity. Contact us for a customized quote.

Do dormant companies need an audit?

In many cases, yes. It is best to confirm and remain compliant.

Get Professional Support from RAKEZ Approved Auditors

Ensure your business remains compliant, transparent, and audit-ready with our professional RAKEZ audit services.

📞 Contact us today for a free consultation and connect with trusted RAKEZ approved auditors in Ras Al Khaimah.

Contact Us

FMA Accounting and Auditing LLC

RAKEZ Approved Auditors, Office No. 3310, Julfar Tower

Al Hisn Road, Dafan Al Nakheel

Ras Al Khaimah, UAE

Phone: +971 52 276 2124

Email: info@fmaaudit.com